The Role of Purchasing Power Parity in Forex Analysis

In the fast-moving world of foreign exchange (forex) markets, traders and analysts rely on a variety of tools to understand currency movements and to make informed decisions. Among these tools, Purchasing Power Parity (PPP) stands out as a concept that offers a long-term perspective on exchange rates by linking currency values to economic fundamentals.

In this article, we explore how PPP functions, why it matters in forex analysis, and how it can be applied thoughtfully alongside other indicators to enrich understanding of currency valuation.

Understanding the Foundations of Purchasing Power Parity

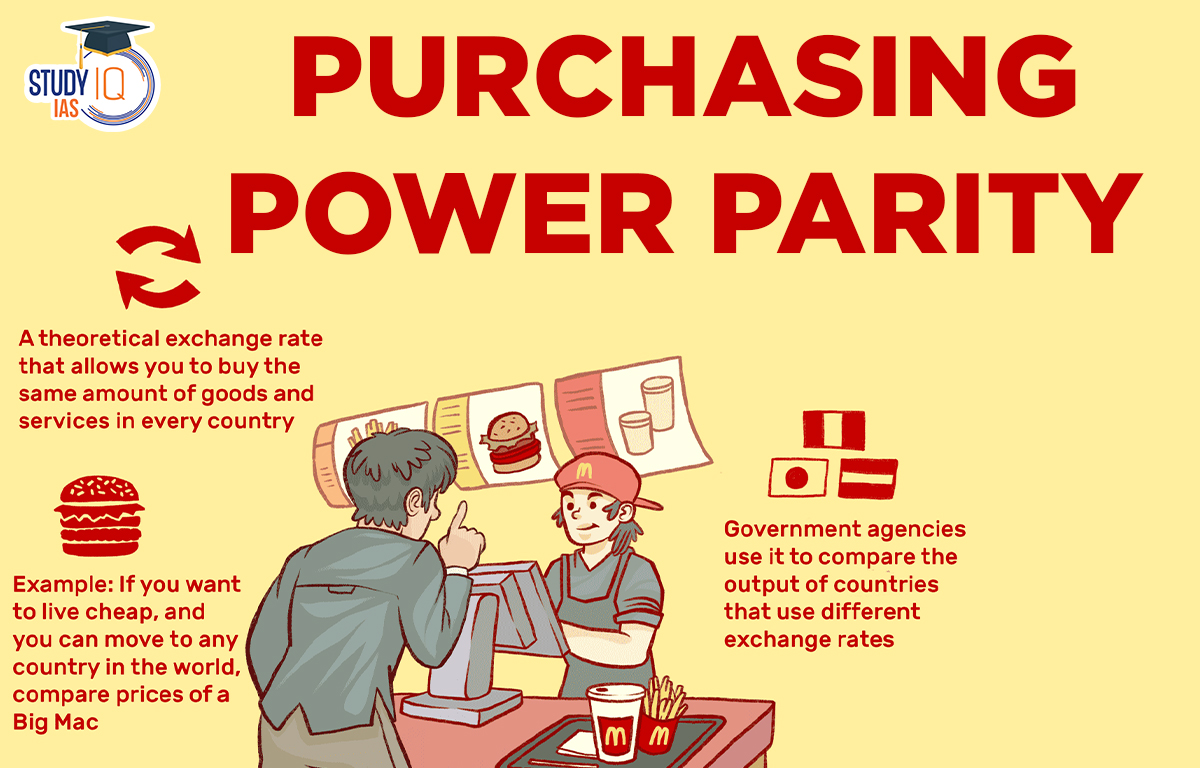

At its core, Purchasing Power Parity is an economic theory that suggests that in the absence of transaction costs and trade barriers, identical goods should cost the same in different countries once prices are expressed in a common currency. In other words, PPP reflects the idea that exchange rates should move toward a rate that equalises the purchasing power of different currencies.

To understand this, imagine a simple example: a basket of common goods costs 100 units in one country’s currency and the same basket costs 200 units in another’s. If the exchange rate between these currencies is 1:1, the theory of PPP would predict that one of the currencies is overvalued or undervalued relative to the other, because after conversion, the price of goods would not be equivalent. This imbalance, in theory, should correct itself through changes in the exchange rate. If you are new to this concept and want a clear definition and context for its use in financial markets, you can start by exploring what is PPP in greater detail.

PPP is often expressed in two forms: absolute PPP and relative PPP. Absolute PPP refers to the direct comparison of price levels between two countries. Relative PPP expands on the base concept to consider inflation rates, suggesting that the change in the exchange rate over time should be proportional to the difference in inflation between two countries. Relative PPP may offer a more realistic framework for forex analysis, given that price levels rarely align perfectly across borders.

Why PPP Matters in Forex Analysis

It can be tempting to dismiss PPP as a theoretical construct with limited practical use in fast-paced currency markets. However, PPP plays several important roles in forex analysis that merit attention:

Providing a Long-Term Valuation Framework

Exchange rates are influenced by countless short-term factors, including interest rate expectations, geopolitical events, market sentiment, and speculative trading. These forces can drive exchange rates far from what economic fundamentals might suggest. PPP provides a grounding framework for long-term valuation by focusing on relative price levels and inflation. Over extended periods, many currencies tend to revert toward levels consistent with PPP, making it a useful benchmark to assess currency misalignment.

Informing Expectations About Inflation and Currency Trends

Because relative PPP depends on inflation differentials, it can offer insights into how changes in consumer prices might influence exchange rates. If one country experiences persistently higher inflation than another, PPP indicates that its currency should gradually weaken to maintain purchasing power equilibrium. This relationship helps analysts and traders interpret inflation data in context, tying macroeconomic trends to potential forex outcomes.

How PPP Is Calculated and Interpreted

Calculating PPP involves comparing price levels across countries. A common approach uses a representative basket of goods and services to estimate price levels. Organisations like the World Bank publish metrics such as the International Comparison Program (ICP) and PPP-adjusted Gross Domestic Product (GDP) estimates, which reflect these comparisons.

For example, if the price of the basket in Country A is $500 in local currency and $800 in Country B’s currency, the PPP exchange rate would be 0.625 units of Country A’s currency per unit of Country B’s currency (500/800). If the actual market exchange rate deviates significantly from this PPP rate, analysts may conclude that one currency is misaligned relative to the other.

Limitations and Practical Considerations

While PPP offers valuable insights, it comes with limitations that every forex analyst should understand:

Short-Term Volatility and Market Complexity

Forex markets react rapidly to economic news, central bank decisions, and geopolitical developments. These influences can overshadow fundamental relationships like PPP in the short run. Traders focused on day-to-day or intraday strategies will find PPP less relevant for immediate decision-making. Instead, PPP is most informative for medium and long-term assessments.

Differences in Consumption Patterns and Price Structures

Each country’s economy has unique consumption patterns, taxes, subsidies, and market structures that affect price levels. A basket of goods considered representative in one country may not translate perfectly to another, making absolute PPP comparisons imprecise. Adjustments and interpretations must account for these structural differences.

Conclusion

Purchasing Power Parity plays a valuable role in forex analysis by linking exchange rates to economic fundamentals such as price levels and inflation. While it is not a standalone predictor of short-term currency movements, PPP provides a long-term valuation framework that helps analysts and traders assess whether a currency appears overvalued or undervalued in real terms.

By understanding what PPP is and how it relates to both macroeconomic conditions and market dynamics, investors and analysts can enhance their interpretive toolkit. Integrating PPP with other analytical methods, from macroeconomic indicators to technical analysis, fosters a more comprehensive and thoughtful approach to forex markets.